Tuesday, February 21, 2006

Tuesday, February 21, 2006

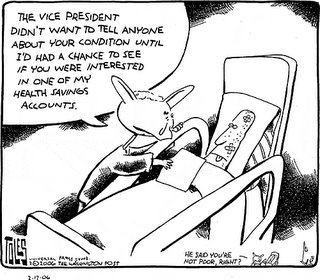

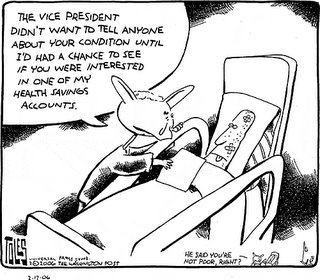

HSA's: a great way to burden individuals & govt; I mean, consumer driven health care, yeah!

"To summarize, I estimate that the President’s budget proposals will cost almost $12 billion dollars per year if fully phased in. I estimate that these proposals will on net raise the number of uninsured (by 600,000 persons), as those left uninsured through firm dropping of insurance exceed those who gain insurance through taking up tax-subsidized high-deductible plans attached to HSAs." (source: Jonathan Gruber's CBPP/MIT study) "To summarize, I estimate that the President’s budget proposals will cost almost $12 billion dollars per year if fully phased in. I estimate that these proposals will on net raise the number of uninsured (by 600,000 persons), as those left uninsured through firm dropping of insurance exceed those who gain insurance through taking up tax-subsidized high-deductible plans attached to HSAs." (source: Jonathan Gruber's CBPP/MIT study)

And from the press release of the study: The analysis, conducted by Jonathan Gruber of M.I.T., projects that while 3.8 million previously uninsured people would gain health coverage through HSAs as a result of the President's proposals, 4.4 million people would become uninsured because their employers would respond to the new tax breaks by dropping coverage and they would not secure coverage on their own. The net effect would be to increase the number of uninsured Americans by 600,000. "The Administration estimates that its HSA-related tax proposals would cost $156 billion over the next ten years, which would worsen the nation's fiscal problems," Robert Greenstein, the Center on Budget and Policy Priorities' executive director, noted. "Professor Gruber's study raises very serious questions about the wisdom of these proposals."... These proposals would eliminate all tax advantages for employer-sponsored coverage (as compared to coverage purchased in the individual health insurance market). Those tax advantages were designed to encourage employers to provide insurance to their workers. As a result, some employers -- typically, small business owners -- would respond to the new HSA tax breaks by dropping coverage for their workers or (in the case of new businesses) electing not to offer coverage in the first place... To estimate the impact of these proposals on health coverage, Professor Gruber employed a micro-simulation model that is very similar to models used by the Congressional Budget Office, the Congressional Joint Committee on Taxation, and the Treasury Department. His findings include: -- Under the proposed tax breaks, the number of people with individual health coverage would increase by 8.3 million when the proposals were fully in effect. Some 3.8 million of these people would previously have been uninsured; about 4 million of them would have switched from employer-sponsored coverage to individual coverage coupled with an HSA; and 500,000 would previously have received coverage through Medicaid. -- Some 8.9 million people would lose employer-sponsored coverage as a result of the tax breaks. About half of them -- 4.4 million people -- would become uninsured, while another 4 million would switch to individual coverage coupled with an HSA, and 500,000 would enroll in Medicaid... Adding to the concerns that Professor Gruber's paper raises, Greenstein said, is the strong probability that the currently uninsured people who would be most likely to gain coverage as a result of the Administration's proposals would be relatively healthy, since they would best be able (with the help of the new tax subsidies) to obtain affordable coverage in the individual market. In contrast, the people most likely to become uninsured would be less-healthy employees in small businesses that dropped coverage, since less-healthy people have the most difficult time obtaining affordable coverage in the individual market.

posted by Unknown |

2/21/2006 09:42:00 PM |

|

|

|

|

| cure this! |

|

We've MOVED! and grown!

Join us at Cure This!...

...where we invite you to create a user account, read, comment, write your own posts. Let's discuss health in its broadest sense, share personal stories, creatively make positive change, and build an online community along the way...

|

|

| what's "to the teeth"? |

|

To the Teeth is a weblog discussing issues of health justice, medicine, race in America,

public health in its broadest sense, healthcare at a local clinic level, and honest discussions around strategies in advocacy. Ok, so it's not so focused, but it's all connected. The regulars who post to this site are:

Anjali Taneja, a resident physician in Family Medicine at Harbor-UCLA in Los Angeles,

California (a recent transplant from the east coast). She also blogs at Los Anjalis and the

Harbor-UCLA Family Medicine Residency blog. She's on the national leadership of the National Physicians Alliance and previously worked as the Jack Rutledge Fellow for Universal Health Care

& Eliminating Health Disparities at AMSA. She dj'ed for several years with the

M U T I N Y dj crew and currently DJs and produces electronic music. (email: movement-at-gmail-dot-com)

and Andru Ziwasimon, a family medicine physician in Albuquerque, New Mexico, and a lead member of the Community Coalition for

Healthcare Access, a diverse group of providers/patients/advocates addressing access issues with the state hospital system, translation and interpretation issues, billing for under and uninsured patients, and other disparities locally.

He created and runs a sustainable and innovative clinic that serves

uninsured patients with quality care and fair prices. He also serves on the leadership of the National Physicians Alliance. (email: aziwa-at-null-dot-net)

and Sri Shamasunder, a resident physician in Internal Medicine at Harbor-UCLA in Los Angeles, CA. He's passionate

about health justice, good music, and spoken word/poetry. (email: elsrizee-at-yahoo-dot-com)

"to the teeth" (idiom):

-> in opposition; directly to one's face

-> completely, fully

-> title of a song by Ani Difranco

-> alotta alliteration

For them RSS lovers (more about rss here), here's the atom site feed for To the Teeth.

|

|

| hot links |

|

Inspiring spoken word from Poetic License

Conversation: Growing up in the Shadow of Chemical Pollution - Michigan and Bhopal

Missing: Minorities in the Health Professions

Angell: The Truth about Drug Companies

Wonderful animation on procrastination!

|

|

| dope orgs/sites |

|

National Physicians Alliance

American Medical Student Association

The Peoples' Institute

Alternet

The Policy Action Network

The Principles Project

Common Dreams

No Free Lunch campaign

Kaiser Family Foundation

Families USA

Consumer Project on Technology

Campaign for a National Health Progam NOW

|

|

| to the teeth archives |

|

12/01/2002 - 01/01/2003

01/01/2003 - 02/01/2003

02/01/2003 - 03/01/2003

04/01/2003 - 05/01/2003

05/01/2003 - 06/01/2003

06/01/2003 - 07/01/2003

07/01/2003 - 08/01/2003

08/01/2003 - 09/01/2003

09/01/2003 - 10/01/2003

10/01/2003 - 11/01/2003

11/01/2003 - 12/01/2003

12/01/2003 - 01/01/2004

01/01/2004 - 02/01/2004

02/01/2004 - 03/01/2004

03/01/2004 - 04/01/2004

04/01/2004 - 05/01/2004

05/01/2004 - 06/01/2004

06/01/2004 - 07/01/2004

07/01/2004 - 08/01/2004

08/01/2004 - 09/01/2004

09/01/2004 - 10/01/2004

10/01/2004 - 11/01/2004

11/01/2004 - 12/01/2004

12/01/2004 - 01/01/2005

01/01/2005 - 02/01/2005

02/01/2005 - 03/01/2005

03/01/2005 - 04/01/2005

04/01/2005 - 05/01/2005

05/01/2005 - 06/01/2005

06/01/2005 - 07/01/2005

07/01/2005 - 08/01/2005

08/01/2005 - 09/01/2005

09/01/2005 - 10/01/2005

10/01/2005 - 11/01/2005

11/01/2005 - 12/01/2005

12/01/2005 - 01/01/2006

01/01/2006 - 02/01/2006

02/01/2006 - 03/01/2006

03/01/2006 - 04/01/2006

04/01/2006 - 05/01/2006

05/01/2006 - 06/01/2006

06/01/2006 - 07/01/2006

07/01/2006 - 08/01/2006

08/01/2006 - 09/01/2006

09/01/2006 - 10/01/2006

10/01/2006 - 11/01/2006

11/01/2006 - 12/01/2006

12/01/2006 - 01/01/2007

01/01/2007 - 02/01/2007

02/01/2007 - 03/01/2007

03/01/2007 - 04/01/2007

07/01/2007 - 08/01/2007

|

|

| poem: history |

|

They caught the peasant walking home from the field.

On the dark road they gagged him and cut off his nose.

This they took to the museum and stuck to the king's noseless statue.

Thus was born the history that is taught in schools.

- Amitava Kumar, "History"

|

|

| Willing to Fight |

|

From Ani Difranco's "Willing to Fight":

"'cause i know the biggest crime

is just to throw up your hands

say

this has nothing to do with me

i just want to live as comfortably as i can

you got to look outside your eyes

you got to think outside your brain

you got to walk outside you life

to where the neighborhood changes"

Excerpts of lyrics to Ani Difranco's poem "Self-evident" (hear her recite this poem on her official website:

yes,

us people are just poems

we're 90% metaphor

with a leanness of meaning

approaching hyper-distillation...

here's a toast to the folks living on the pine ridge reservation

under the stone cold gaze of mt. rushmore

here's a toast to all those nurses and doctors

who daily provide women with a choice

who stand down a threat the size of oklahoma city

just to listen to a young woman's voice

here's a toast to all the folks on death row right now

awaiting the executioner's guillotine

who are shackled there with dread and can only escape into their heads

to find peace in the form of a dream

cuz take away our playstations

and we are a third world nation

under the thumb of some blue blood royal son

who stole the oval office and that phony election

i mean

it don't take a weatherman

to look around and see the weather

jeb said he'd deliver florida, folks

and boy did he ever

and we hold these truths to be self evident:

#1 george w. bush is not president

#2 america is not a true democracy

#3 the media is not fooling me

cuz i am a poem heeding hyper-distillation

i've got no room for a lie so verbose

i'm looking out over my whole human family

and i'm raising my glass in a toast

here's to our last drink of fossil fuels

let us vow to get off of this sauce

shoo away the swarms of commuter planes

and find that train ticket we lost

cuz once upon a time the line followed the river

and peeked into all the backyards

and the laundry was waving

the graffiti was teasing us

from brick walls and bridges

we were rolling over ridges

through valleys

under stars

i dream of touring like duke ellington

in my own railroad car

i dream of waiting on the tall blonde wooden benches

in a grand station aglow with grace

and then standing out on the platform

and feeling the air on my face

give back the night its distant whistle

give the darkness back its soul

give the big oil companies the finger finally

and relearn how to rock-n-roll...

|

|

| subcity |

|

Lyrics from Tracy Chapman's "Subcity"

People say it doesn't exist

'Cause no one would like to admit

That there is a city underground

Where people live everyday

Off the waste and decay

Off the discards of their fellow man

Here in subcity life is hard

We can't receive any government relief

I'd like to please give Mr. President my honest regards

For disregarding me

They say there's too much crime in these city streets

My sentiments exactly

Government and big business hold the purse strings

When I worked I worked in the factories

I'm at the mercy of the world

I guess I'm lucky to be alive

They say we've fallen through the cracks

They say the system works

But we won't let it

Help

I guess they never stop to think

We might not just want handouts

But a way to make an honest living

Living this ain't living

|

|

| the revolution will not be televised |

|

Lyrics from Gill Scott Heron's "The Revolution Will Not Be Televised"

You will not be able to stay home, brother.

You will not be able to plug in, turn on and cop out.

You will not be able to lose yourself on skag and skip,

Skip out for beer during commercials,

Because the revolution will not be televised.

The revolution will not be televised.

The revolution will not be brought to you by Xerox

In 4 parts without commercial interruptions.

The revolution will not show you pictures of Nixon

blowing a bugle and leading a charge by John

Mitchell, General Abrams and Spiro Agnew to eat

hog maws confiscated from a Harlem sanctuary.

The revolution will not be televised.

The revolution will not be brought to you by the

Schaefer Award Theatre and will not star Natalie

Woods and Steve McQueen or Bullwinkle and Julia.

The revolution will not give your mouth sex appeal.

The revolution will not get rid of the nubs.

The revolution will not make you look five pounds

thinner, because the revolution will not be televised, Brother.

There will be no pictures of you and Willie May

pushing that shopping cart down the block on the dead run,

or trying to slide that color television into a stolen ambulance.

NBC will not be able predict the winner at 8:32

or report from 29 districts.

The revolution will not be televised.

There will be no pictures of pigs shooting down

brothers in the instant replay.

There will be no pictures of pigs shooting down

brothers in the instant replay.

There will be no pictures of Whitney Young being

run out of Harlem on a rail with a brand new process.

There will be no slow motion or still life of Roy

Wilkens strolling through Watts in a Red, Black and

Green liberation jumpsuit that he had been saving

For just the proper occasion.

Green Acres, The Beverly Hillbillies, and Hooterville

Junction will no longer be so damned relevant, and

women will not care if Dick finally gets down with

Jane on Search for Tomorrow because Black people

will be in the street looking for a brighter day.

The revolution will not be televised.

There will be no highlights on the eleven o'clock

news and no pictures of hairy armed women

liberationists and Jackie Onassis blowing her nose.

The theme song will not be written by Jim Webb,

Francis Scott Key, nor sung by Glen Campbell, Tom

Jones, Johnny Cash, Englebert Humperdink, or the Rare Earth.

The revolution will not be televised.

The revolution will not be right back after a message

bbout a white tornado, white lightning, or white people.

You will not have to worry about a dove in your

bedroom, a tiger in your tank, or the giant in your toilet bowl.

The revolution will not go better with Coke.

The revolution will not fight the germs that may cause bad breath.

The revolution will put you in the driver's seat.

The revolution will not be televised, will not be televised,

will not be televised, will not be televised.

The revolution will be no re-run brothers;

The revolution will be live.

|

|

|

|

|